In 11/2025, Manuvia conducted a survey among Slovak employers. The results show a clear trend: the planned fiscal measures will increase company costs and weaken their competitiveness.

Key findings of the survey

- 100% of companies expect cost growth – especially contributions, wages, external services, and energy.

- 68% of businesses will limit recruitment in 2026, a third is considering cutting benefits.

- While wages will grow, it will be slower – most companies plan increases up to 6%.

- Companies are reacting with savings: cost optimization, automation, limited use of external services.

- 74% of managers anticipate a negative impact on competitiveness.

Detailed information about the survey:

In November 2025, we conducted a survey among Slovak employers. The goal of the survey was to assess how the planned public finance consolidation measures will affect the business environment, specifically operating costs, personnel policy, wage development, company benefits, and investments

You can read the complete survey results here.

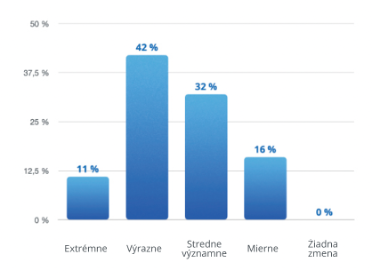

Expected increase in operating costs

None of the companies surveyed expect the consolidation measures to have no impact on their costs – all anticipate an increase. Most companies (approximately 53%) expect a significant (42%) or even extreme increase (11%) in operating costs. Roughly a third (32%) expects a moderately significant increase and the rest a slight increase.

Companies expect costs to grow especially in these areas:

- Contributions and legislative fees (95% of respondents).

- Wage costs (74% of respondents).

- External services (58%).

- Energy (42%).

It follows that companies expect the greatest pressure in employee costs – whether it is contributions and fees or increased wages.

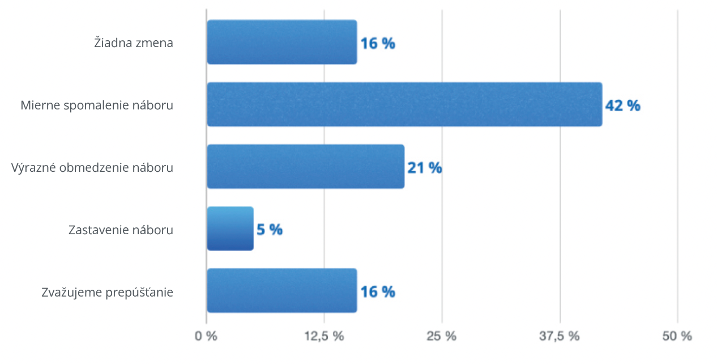

Impact on employment and benefits

In connection with consolidation, more than two-thirds of companies (68%) plan to limit the hiring of new employees in 2026. Most often, this involves a slight slowdown in recruitment (42%), but 21% announce a more significant limitation and 5% even a recruitment freeze. Approximately 16% of respondents are considering laying off existing employees. Only 16% of companies state that the consolidation will not affect their hiring plans.

Regarding existing jobs, the majority (58%) do not yet anticipate having to proceed with layoffs. 21% of companies explicitly admit staff reductions, while another 21% have not yet decided. About a third of companies (32%) plan to consider restricting employee benefits in 2026. The largest group of respondents (42%) does not plan to cut benefits. Companies admitting cuts would primarily target financial rewards (bonuses and commissions), and marginally non-financial benefits (n.g., contributions to education).

Wages in 2026

Despite unfavorable circumstances, companies are trying to continue increasing wages. Approximately 68% of respondents declared a plan to increase wages in 2026, while the remaining 32% are not yet decided. The plan for moderate growth within single-digit percentages prevails, with more than half of respondents planning an increase up to 6%.

However, consolidation may limit the wage policy of companies. Almost half of managers (47%) anticipate that the planned measures will have a significant negative impact on the possibilities of increasing wages in their company. Another 37% expect a slight limitation of the scope for increasing salaries.

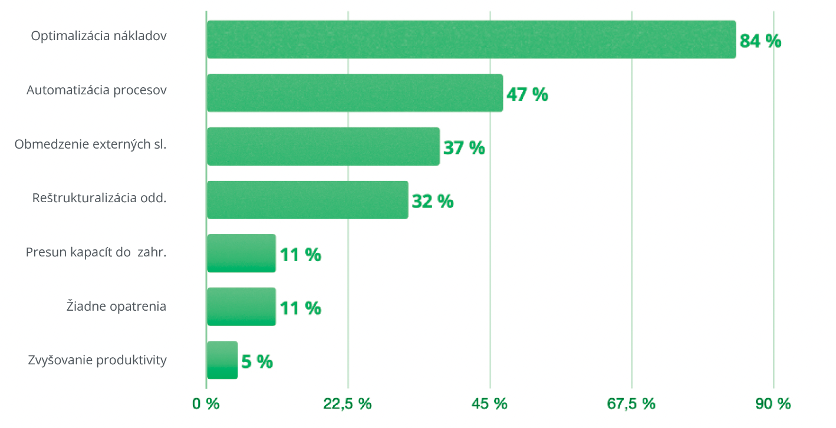

Company countermeasures

Companies are actively preparing to mitigate the negative effects of consolidation.

The most frequently planned measures:

- Optimization of operating costs (84% of companies).

- Investments in automation and digitalization of processes (47%).

- Restriction of the use of external services (38%).

- Restructuring of the organizational structure (32%).

Only a smaller part of businesses (11%) sees a solution in relocating capacity abroad. Overall, the effort to find internal reserves prevails – in savings, innovations, and organizational changes – instead of restrictive personnel interventions.

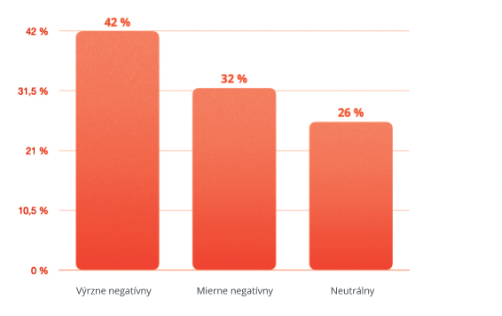

Competitiveness and expectations from the state

From the management’s perspective, fiscal measures pose a significant risk to the competitiveness of Slovak businesses. Approximately three-quarters of respondents (74%) rate the expected impact of consolidation on their competitiveness negatively. Only a quarter (26%) estimates the impact as neutral; no manager expects a positive contribution.

The companies consider the following state measures to be the most problematic:

- Steps increasing labor costs (increase in contributions, longer paid sick leave).

- Introduction of a new transaction tax.

- Unexpected and frequent changes in legislation.

At the same time, companies formulated what would help them most from the state:

- Reduction of the overall tax-and-contribution burden (n.g., cancellation of the planned transaction tax).

- Seeking reserves on the state’s own expenditure side and slimming down state administration.

- Greater stability and predictability of the business environment.

Conclusion

The planned consolidation is causing considerable concern in the corporate sphere. Most companies expect cost growth and a negative impact on their functioning and competitiveness. They are responding to this pressure with internal austerity measures, but at the same time, they clearly formulate expectations towards the government, which concern the reduction of the burden and the stability of the environment. Relevant dialogue between the public and private sectors will be key to achieving a balance between the recovery of public finances and the preservation of the prosperity of Slovak companies.